Product

Senior Manager, User Experience

Vanguard

Malvern, PA

Charlotte, NC

Throughout my career, I have held numerous leadership positions within the realm of product design, predominantly at Vanguard.

During my tenure at Vanguard, I spearheaded the user experience design for a diverse array of products, each serving one of the various business segments. These initiatives significantly enhanced the digital interactions for a wide range of stakeholders, including self-directed investors, advised clients, retirement plan participants, plan sponsors, and Vanguard's own crew members (employees).

Through strategic UX endeavors across different product lines, I led my teams not only in redefining the digital journey for the users but also in cementing a legacy of innovation and unparalleled excellence in product design.

My leadership path is marked by a dedication to deeply understanding user needs, promoting cross-functional collaboration, and championing continuous improvements. These core principles stand as the foundation of my approach.

CASE STUDY #1

Personal Advisor

Services

Vanguard's Personal Advisor Services combines the benefits of professional financial advice with sophisticated technology to offer personalized investment management and financial planning. This service is designed for investors seeking a tailored approach to managing their financial goals.

Executive Summary

Following extensive research and analytical deliberation, the leadership of Vanguard's Retail Division resolved to embark on a transformative journey by launching the Personal Advisor Services (PAS) initiative. This strategic move aimed to significantly augment the exiting portfolio with a cutting-edge, personalized advisory service. The initiative represented a pivotal shift in our business model and client engagement approach, necessitating the acquisition of over 1,000 Financial Advisors and the crafting of an exceptional user experience to set new industry benchmarks.

My team was entrusted with the pivotal task of architecting the user experience (UX) across the entire product lifecycle. This encompassed the initial marketing engagement, through conversion and onboarding, and extended into the ongoing client and advisor experiences. This case study is specifically tailored to delineate the design process related to enhancing both client and advisor experiences. For insights into the marketing dimensions of this initiative, I invite you to consult the Marketing case studies.

-

The PAS initiative was a monumental endeavor that required meticulous planning and synchronization with IT development timelines. Our initial focus was on establishing a robust backend infrastructure that aligned with Vanguard's esteemed investment principles, allowing us to envisage a scalable user experience. An integrated planning approach facilitated the creation of a comprehensive vision and roadmap, ensuring all phases of client and advisor engagement were thoroughly planned before development commenced.

To effectively manage this vast undertaking, we organized specialized teams for distinct aspects of the experience - Team Prosperity Pioneers for investors and Team Advice Cream for advisors. Each team was a synergy of UX Strategists, Designers, Usability Engineers, Content Strategists, Front-End Developers, and Product Owners, focusing on creating seamless onboarding, investing, and maintenance journeys.

-

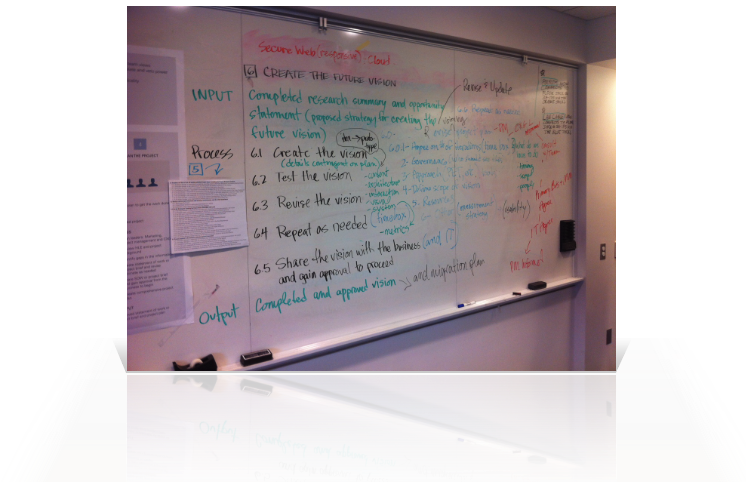

Our design process was deeply collaborative, involving stakeholders from across the spectrum to ensure the final product resonated with both clients and advisors. Design Sprints and workshops with Subject Matter Experts (SMEs) and IT partners were instrumental in refining our understanding and hypotheses about the user experience.

The onboarding phase was particularly critical, prompting us to engage in SME interviews and comparative research to elevate the user experience from the outset. The design of a client dashboard, featuring a prominent communication hub, emerged as a key innovation to facilitate advisor-client interactions and streamline the financial planning process.

-

The transition from design to development was seamless, thanks to the groundwork laid during the planning stages. Our development teams appreciated the clarity and direction provided by the design phase, allowing for efficient and informed development. Leadership engagement in the design of key service components underscored the collaborative spirit of this initiative.

-

Although PAS was a novel offering without direct precedents, we implemented a rigorous measurement framework to gauge user satisfaction and efficiency. The insights garnered from inline surveys and efficiency studies not only validated our approach but also guided the continuous improvement of the PAS experience.

In conclusion, the Personal Advisor Services initiative stands as a testament to Vanguard's commitment to innovation, client satisfaction, and operational excellence. Through strategic foresight, collaborative planning, and a client-centered design ethos, we have set new standards for personalized financial advisory services.

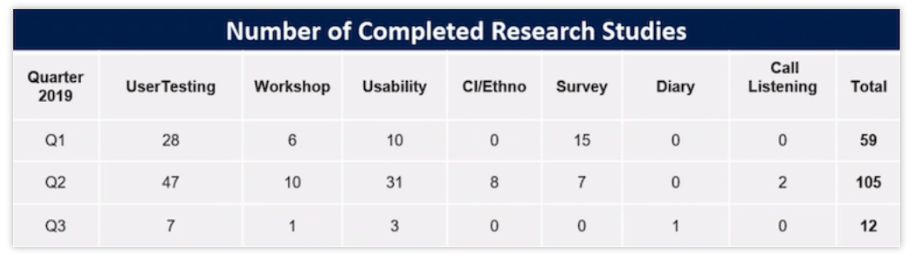

On hundred and seventy-six unique user studies were conducted.

A non-stop flow of user insight led to rapid, light-weight collaborative ideation and iteration.

Culminating in a personalized experience for the investor, as well as the Financial Advisor.

CASE STUDY #2

Retail Investment Account

A self-directed investor, or retail investment account owner, manages their own investment portfolio without a financial advisor's help. They make their own choices on stocks, bonds, mutual funds, ETFs, and more, relying on personal research and risk tolerance. Using online brokerage accounts, these investors have more control and possibly save on professional fees, but this approach demands significant financial knowledge, time, and responsibility for their investment results.

Executive Summary

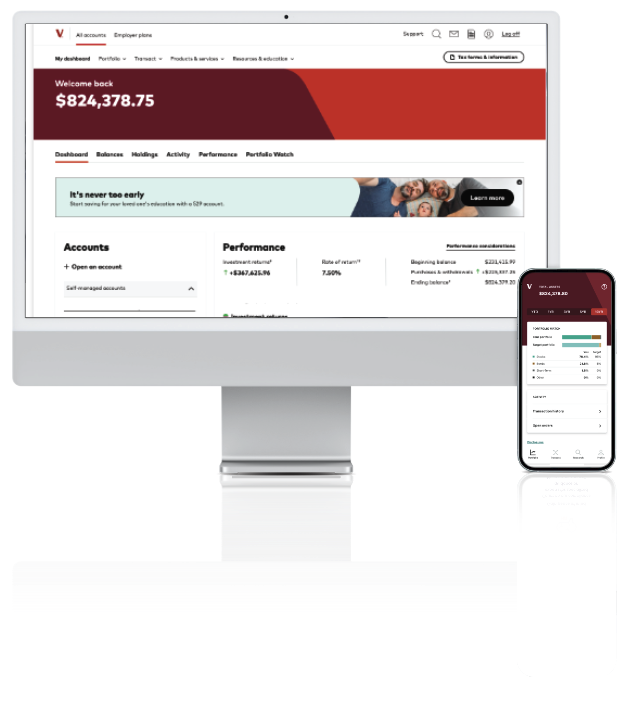

Vanguard undertook a strategic initiative to revamp the digital experience for self-directed investors, prioritizing the top ten pages with the most traffic. The project involved comprehensive research to understand user needs, adopting both qualitative and quantitative methods.

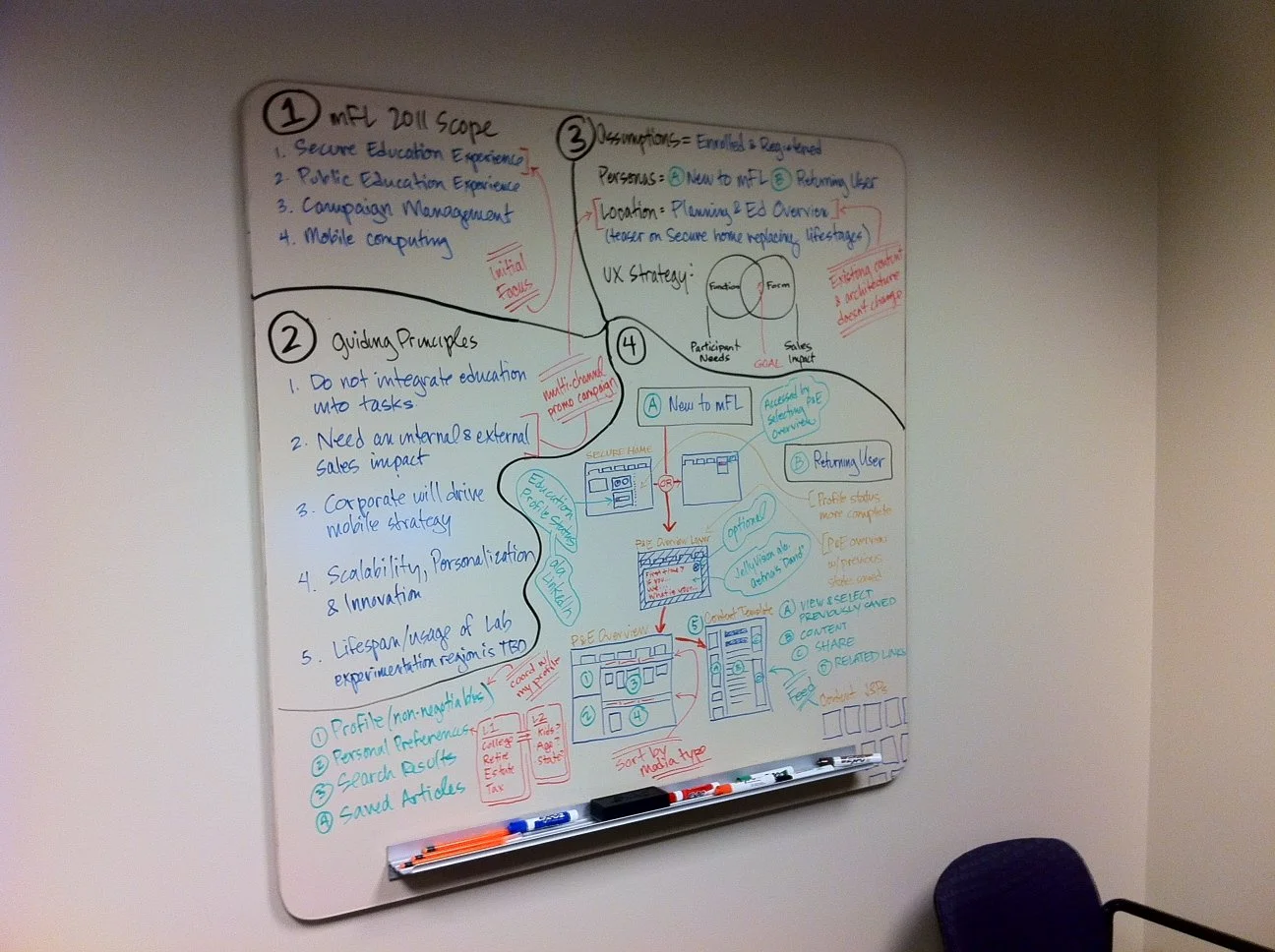

After identifying the current state experience and unmet needs, the strategy became anchored by a future state vision and digital roadmap, ensuring development efforts were aligned and focused on addressing critical user needs. The adoption of a rapid iteration process allowed for agile responses to feedback and market changes. Key to the initiative was the integration of Lean Design with Agile methodologies, promoting cross-divisional collaboration and enhancing operational efficiency.

Levels of process rigor were evaluated and agreed upon before creating a vision.

Notable outcomes included the development of a secure, user-focused site, and support for mobile applications across key platforms. A significant reevaluation of the Account Maintenance section led to improvements in findability rather than task redesign, informed by direct insights from the Crew Digital Council (a coalition of front line Customer Service managers).

This concise effort highlights Vanguard's commitment to a user-centric, agile approach in enhancing the personal investor experience, demonstrating a benchmark in digital financial services engagement.

-

The primary challenge was to enhance the digital engagement for self-directed investors. To address this, my team and I initiated an extensive research program, combining both qualitative and quantitative methods to gain deep insights into user needs. Our mobile-first strategy was underpinned by a blend of formative and summative research techniques, ensuring a robust understanding of our users.

-

We developed a detailed vision for the future state of the product, along with a digital roadmap that prioritized critical user needs and aimed to bridge experience gaps. This foresighted approach served as a strategic guide, aligning development efforts across design, engineering, marketing, and customer support towards a common goal. By focusing on a user-centered design methodology, we ensured that the product development was both agile and aligned with long-term objectives.

-

A key component of our strategy was the implementation of a rapid test-and-learn cadence. The team embraced agile practices to promote rapid iteration, continuous feedback, and adaptive planning. This approach was instrumental in managing the workflow across multiple development teams, ensuring that the project could evolve in real-time in response to user feedback and changing requirements. Despite the challenges posed by having a limited number of designers, the team placed a strong emphasis on strategic planning and execution. This rigorous approach allowed them to stay ahead of potential development hurdles, ensuring that the project's ambitious goals were not only met but exceeded.

-

We championed the enterprise-wide adoption of Lean Design processes, integrated seamlessly with Agile software development life cycles (SDLC). This enhanced cross-divisional collaboration and operational efficiency, particularly through the establishment of the Crew Digital Council, which provided direct insights from the front lines.

-

In developing Vanguard's Portfolio Watch, leveraging data to understand user behavior was crucial. This data-driven approach enabled continuous refinement of the application, enhancing user engagement and simplifying complex processes for a better user experience.

-

Our work on Vanguard’s Secure Site focused on its most visited pages, employing A/B and multivariate testing to deliver client-driven experiences efficiently. Additionally, we supported the iPad, iPhone, and Android apps, ensuring capability parity across devices and modernizing designs and back-end systems. Notably, we launched a BETA app for Android in the App Store.

-

A significant challenge was reimagining the Account Maintenance section. Through research and iteration, we debunked initial hypotheses, learning that the main issue was the findability of the section rather than the interaction design of tasks. This led to experimenting with various solutions, ultimately gaining consensus on a strategy set to be implemented early in the subsequent year.

-

This comprehensive effort to enhance the personal investor experience at Vanguard highlights the power of a user-centric, data-driven approach. By employing rapid iteration, embracing agile methodologies, and focusing on strategic visioning, we significantly improved digital engagement for self-directed investors. This case study demonstrates Vanguard's commitment to innovation, operational excellence, and delivering superior client experiences in the digital age.

Traffic was monitored to determine the top ten pages

CASE STUDY #3

Enhancing Participant Engagement in Retirement Plans

Situation

Upon reviewing the digital engagement tools for retirement plan participants, it became evident that the user experience was lacking. Participants found the tools non-intuitive and challenging to navigate, leading to low engagement levels. This was a critical issue, as active and informed participation is essential for effective retirement planning.

Action

To address this, we embarked on a comprehensive redesign of the digital experience for retirement plan participants. The project involved streamlining the user interface for ease of navigation and introducing personalized guidance tools to help participants make informed decisions about their retirement savings. We focused on making financial planning tools more accessible, enabling users to understand their investment options better and how changes would affect their retirement outcomes.

Result

The redesigned digital engagement platform led to a significant improvement in participation rates among employees, with an average increase of 0.07% across relevant plans. This uptick is a testament to the effectiveness of intuitive design and personalized tools in fostering engagement. Additionally, there was a noticeable shift towards more appropriate asset allocation, as participants felt more confident in their investment choices. The increase in deferral percentages further highlighted the success of our initiative, demonstrating that participants were not only more engaged but also more proactive in planning for their retirement. These improvements collectively represent a stride towards ensuring employees are better prepared for retirement, both financially and emotionally.

CASE STUDY #4

Data-Driven Transformation for Retirement Plan Sponsors

Situation

The existing digital experience for retirement plan sponsors was far from optimal, with outdated interfaces and complex navigation systems. This inadequacy hindered sponsors' ability to manage employee 401(k) participation effectively and respond to their needs promptly.

Action

We initiated a series of contextual observations to delve deep into the sponsors' experiences, capturing their interactions, frustrations, and feedback when using the existing tools. This approach allowed us to gather rich qualitative insights into the daily challenges sponsors faced. Following this, we conducted a thorough analysis of the collected data, transforming these qualitative insights into quantifiable trends and patterns. This analysis paved the way for a strategic roadmap that guided the overhaul of the digital experience for sponsors. Our actions were informed by a deep understanding of the sponsors' needs, ensuring that the solutions we developed were both innovative and highly relevant. We focused on creating intuitive interfaces, implementing personalized guidance tools, and designing effective communication strategies that resonated with the sponsors' real-world challenges.

Result

The overhaul, guided by an insightful roadmap developed from our contextual observations and data analysis, resulted in a profound transformation of the digital experience for retirement plan sponsors. Post-implementation, we conducted an efficiency study comparing task completion times before and after the introduction of the new tools. The study revealed a 12% reduction in the overall number of clicks required for task completion, illustrating the significant usability improvements and time savings achieved. This reduction not only highlighted the efficacy of the new interfaces and tools in streamlining the management process but also indicated a freeing up of valuable resources that could be redirected towards more strategic activities. The development journey, steered by the meticulously crafted roadmap, ensured that every feature introduced was in direct response to the identified needs and challenges of the sponsors. This tailored approach led to the creation of a platform that not only met but exceeded sponsor expectations in terms of functionality and ease of use. The positive feedback from sponsors underscored the success of the initiative, demonstrating the critical role of a data-driven, user-focused strategy in achieving meaningful digital transformation in retirement plan management.

“Chuck is a pleasure to work with, a very strategic thought leader in UX/CX, an incredible leader, and true Rockstar talent.”

— Senior Business Executive, Vanguard

CASE STUDY #5

Revolutionizing Internal Applications UX at Vanguard

Situation

When I began analyzing Vanguard's internal applications, including our proprietary CRM and corporate intranet, it was clear they were not meeting the needs of our diverse employee base. The complexity and inefficiency of these tools were hindering daily operations, causing frustration and reducing productivity across the organization.

Action

My team and I embarked on a journey to transform these applications by employing a user-centered design process. We initiated comprehensive research to understand the technological needs and pain points of our users, identifying five distinct user types with overlapping needs. Utilizing a customized Kano Model for analysis, we distilled the feedback into actionable insights. This led to the development of a "smoke and mirrors" prototype for a future-state intranet designed to meet these needs while ensuring technical feasibility. With executive endorsement, we assembled a multidisciplinary team to turn this vision into reality, guided by a strategic implementation roadmap for the rollout of the enhanced intranet and operational applications.

Result

The implementation of the redesigned internal applications at Vanguard marked a significant leap forward in operational efficiency and user satisfaction. One of the standout features was the introduction of a new user customization capability, allowing employees to tailor their workspace by pulling different small apps from a universal "drawer." This innovative feature was designed with role-based permissions, ensuring that the availability of apps was aligned with the user's role and access rights.

This customization led to a 15% reduction in the time employees spent navigating and performing routine tasks, equating to an annual productivity cost saving of approximately $2 million. Moreover, the introduction of the app drawer and customization options contributed to a 40% increase in user satisfaction with the intranet, as reported in our internal surveys.

Operational efficiency across the organization saw a 20% uplift, with streamlined workflows and enhanced collaboration. The capability to customize and access role-specific tools on demand not only empowered our employees but also facilitated quicker decision-making processes. The project has not only established a new benchmark in UX design within Vanguard but also underscored the impact of thoughtful, user-centered design in creating a more efficient, innovative, and adaptable workplace environment.